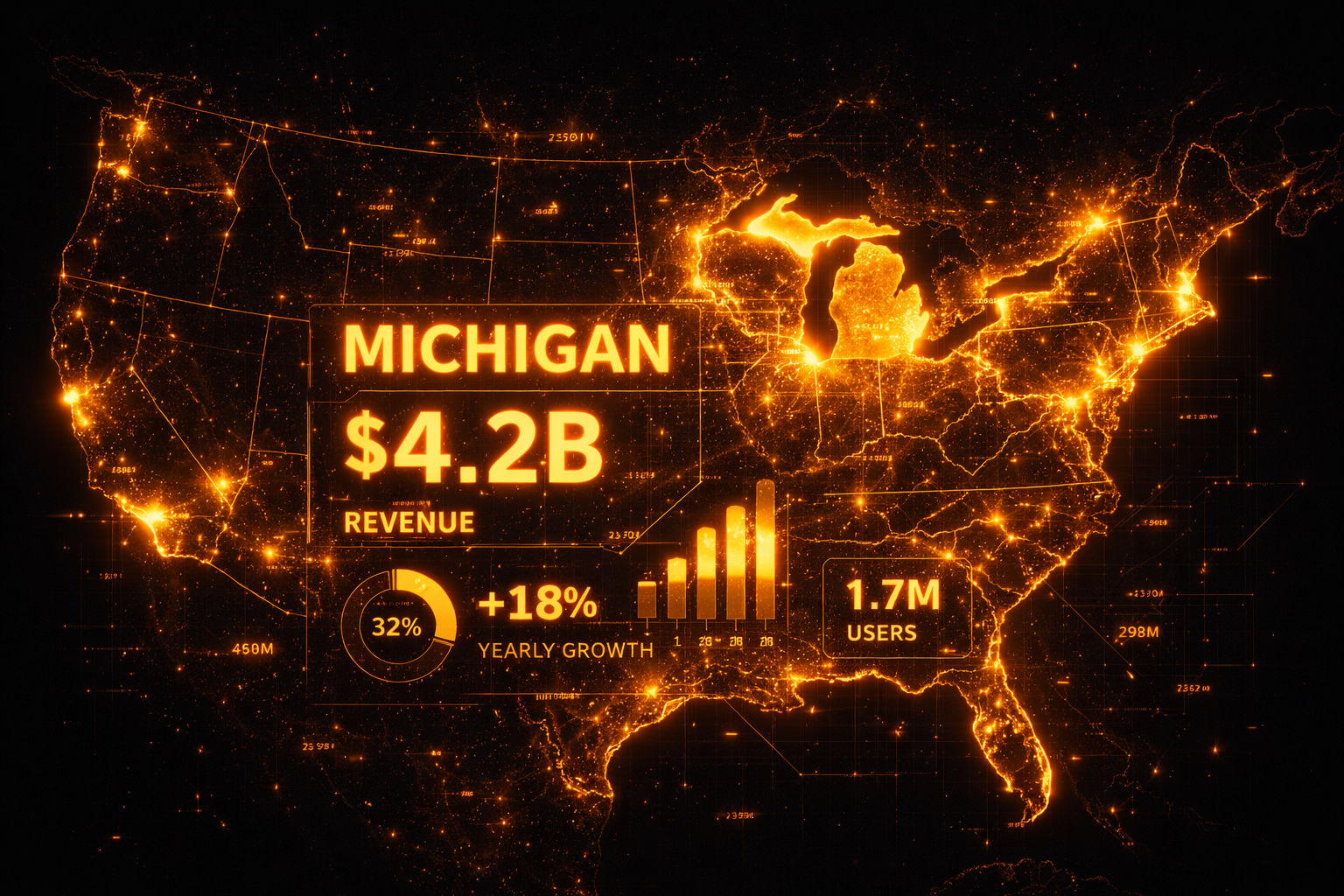

Michigan continues to be one of the strongest performing regulated US iGaming markets, posting $298.3 million in gross receipts for January 2026, a 22.8% increase versus 2025.

The Michigan Gaming Control Board (MGCB) reported $356.3 million in combined internet gaming and online sports betting gross receipts for January 2026, with iGaming alone accounting for $298.3 million of that total.

Year-on-year, iGaming adjusted gross receipts (AGR) grew 22.8%, a strong indicator of continued market maturation and player base growth in one of the United States' most established regulated online casino states.

Breaking down the numbers

Combined adjusted gross receipts for January totalled $323.3 million, with iGaming contributing $286.3 million and online sports betting adding $37.0 million. The month-on-month decline of 10.9% from December 2025 is consistent with seasonal post-holiday patterns seen in previous years.

Online sports betting AGR declined 39.5% month-on-month, a steeper drop reflecting the end of the NFL regular season and the absence of major December sporting events. Year-on-year, sports betting AGR was down 32.5%, partly attributable to favourable sporting outcomes for books in January 2025.

Operators submitted $57.1 million in taxes and payments to the State of Michigan in January, underlining the fiscal contribution that regulated iGaming makes to state governments.

The US iGaming opportunity

Michigan operates alongside New Jersey, Pennsylvania, West Virginia, Connecticut, Delaware, and Rhode Island as a fully regulated US online casino state. The US iGaming market is projected to grow to $133 billion by 2029, according to industry forecasts.

For operators assessing the North American opportunity, Michigan's consistent double-digit year-on-year growth provides a compelling data point. The sweepstake casino model, which operates legally in 45+ US states without a gambling licence, continues to run parallel to traditional regulated markets and serves as a compliant entry route for operators without a state-specific gaming licence.